-

India’s gross domestic product (GDP) growth rebounded to 6.2 per cent in the final quarter of 2024, allaying concerns of a deep cyclical slowdown in domestic demand.

“ANZ Research believes a trade deal by the third quarter of 2025 between the US and India will likely bring down the effective US tariff on Indian goods into the palatable range of 10-15 per cent.”

But high frequency data does not guarantee stronger growth in financial year 2026 (fiscal year ending March 2026).

Growth will likely gravitate towards 6 per cent, much below potential, warranting a stronger policy push.

Downside risks are rising with US tariffs, global economic and policy uncertainty.

And India will not be immune from these.

Room for policy push

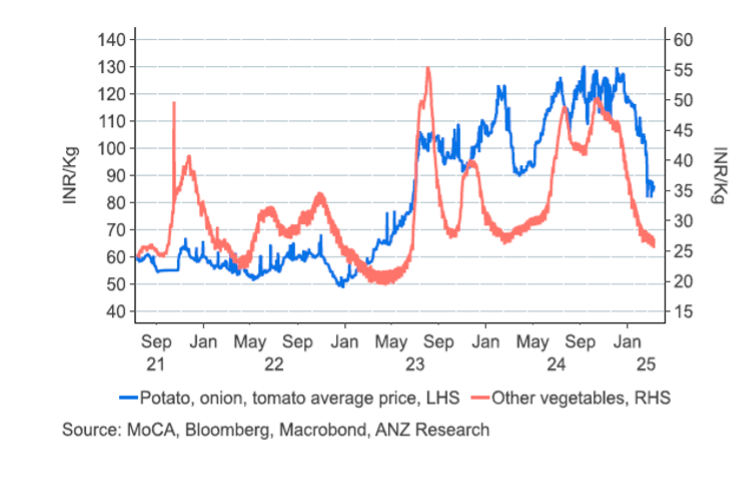

While the fiscal policy is tied to a contractionary budget, a sharp disinflation in food Consumer Price Index (CPI) has created room for a bolder monetary policy push to growth.

Assuming extreme weather remains at bay, ANZ Research now forecasts a meaningful rate-cutting cycle, as inflation will likely remain anchored around 4 per cent in 2025.

US reciprocal tariff rate of 26 per cent on Indian goods has been suspended for now. But the universal 10 per cent applies, roughly seven percentage points more than before. The future of tariffs remains uncertain, and hopes are pinned on the US-India trade deal, which is underway. A potential slowdown in global goods trade and growth will be a bigger concern.

ANZ Research has downgraded balance of payments forecasts materially, as the financial account may remain under stress for longer due to weak direct and portfolio investment flows.

Fundamentally, weak growth coupled with tariff-related headwinds mean the rupee should trade with a depreciation bias in 2025. But error bands around any forecast are large. The current environment favours bonds, especially as the Reserve Bank of India is easing monetary conditions.

Growth to slow

The Ministry of Statistics recently revised up financial year growth to a solid 9.2 per cent and projected financial year 2025 at 6.5 per cent, 10 basis points above ANZ Research forecast.

The government expects public spending and the ‘Kumbh’ effect will likely buoy growth in fourth quarter financial year 2025 (January-March 2025) to 7.6 per cent year on year.

‘Maha Kumbh’ is a Hindu religious event that occurs once every 144 years. This year, nearly 400–500 million people gathered in January and February 2025 in the state of Uttar Pradesh to take a dip in the holy river Ganges.

Beyond the spurt in the first quarter of 2025, there are not many strong growth drivers to sustain recovery into financial year 2026. The revival in consumption growth is not broad-based, driven largely by rural recovery. Once the base normalises for agricultural output and rural demand, growth rates will likely return to trend.

The resurging weakness in rural indicators, such as real wage and two-wheeler sales growth, is concerning.

Urban household balance sheets remain stretched with moderate income growth, pile of debt and capital losses due to equity market correction. Manufacturing growth remains subdued.

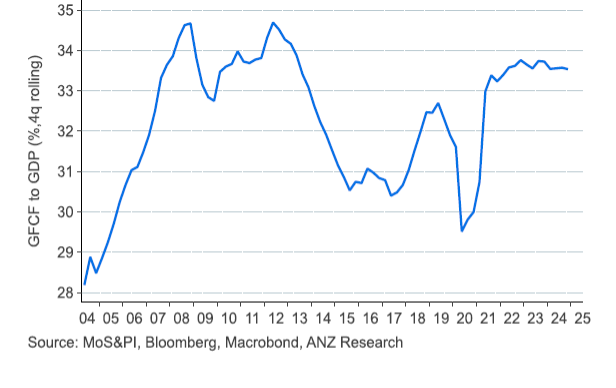

The investment rate has peaked around 33.5 per cent of GDP. Public infrastructure spending is supportive, but a strong business capex cycle will likely remain elusive, given the global economic uncertainties and domestic demand slowdown. Private real estate demand, which strongly supported growth in recent years, is easing. The lower borrowing costs in 2025 will support bank credit, but industrial demand may remain constrained.

Investment rate has peaked

{image1}

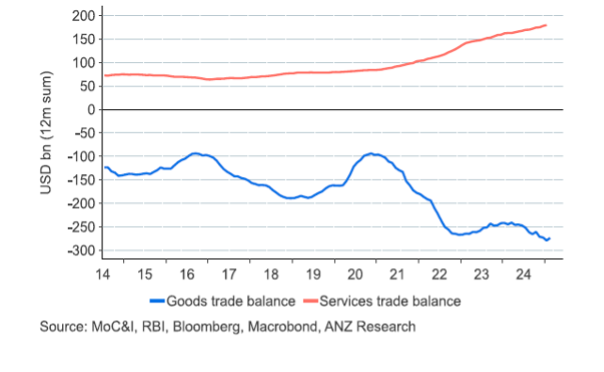

The goods export outlook is clouded by tariff-related uncertainties, even as the 90-day pause on the 26 per cent reciprocal tariff is a big relief.

Deal to be struck?

ANZ Research believes a trade deal by the third quarter of 2025 between the US and India will likely bring down the effective US tariff on Indian goods into the palatable range of 10-15 per cent. India will have to sacrifice a part its trade surplus with the US, as a result.

However, the tariff war is deepening between the US and China, rattling global markets. India is typically considered a domestically driven economy. But, over recent years, given its rising goods and services exports, its exposure to US and global growth slowdown has increased.

Public spending support to growth will be limited by a contractionary budget impulse, both by the central and state governments. In the baseline, public debt and deficit ratios will likely decline further in financial year 2026.

Goods vs services trade balance

{image2}

Inflation falls, more cuts

Fresh crop arrivals, falling input costs, easing food demand and retail food trade margins imply a wholesome improvement in the food inflation ecosystem.

Vegetable prices eased rapidly in the first quarter of 2025, bringing headline inflation below the 4 per cent target.

Food inflation has dropped

{image3}

If extreme weather remains at bay, CPI inflation will likely remain anchored around 4 per cent for the whole of 2025. The Reserve Bank India (RBI) has delivered two rate cuts and lowered its inflation projections, which now reflect a quicker alignment with the 4 per cent target.

We also believe imported inflation will remain in check as the exchange rate passthrough to CPI may be weakened by factors such as the recent rupee appreciation, benign commodity prices, subdued consumer demand, stable producer profit margins and easing inflation expectations.

Given the current growth-inflation dynamics, we expect at least two more successive 25 basis points policy rate cuts in 2025, taking the terminal repo rate to 5.50 per cent by August 2025, with risks of more if inflation remains well behaved and global growth slows.

This will ensure an accommodative real policy rate if inflation averages close to 4 per cent over the forecast period. The key risk to this view is from any weather extremities that can disrupt food supply.

Financial account under stress

Monthly net Foreign Direct Investment (FDI) has slipped into the negative territory and the rebound in equity flows remains vulnerable to further deterioration in global risk sentiment.

High US yields and rupee depreciation have kept foreign buyers of Indian bonds on the backfoot. All these factors have culminated into a sharp financial account stress.

ANZ Research has materially downgraded its balance of payments expectations and do not rule out a deficit if external headwinds worsen in 2025.

There is no easy fix to this problem. Weak FDI flows remain tied to an uncertain global economic outlook, marred by trade tensions and policy uncertainty.

The ongoing risk-off due to fading US exceptionalism does not augur well for emerging markets, for which strong US growth has been a vital support. Higher US tariffs add further risks.

Depreciation bias for the rupee

The Indian rupee’s rise over March has broadly closed its underperformance gap with Asian peers.

Two factors have changed unexpectedly since the rupee slid sharply in the beginning of 2025 – the broad dollar index and India’s CPI inflation have both fallen.

There is no excessive pressure on the rupee to depreciate now.

The RBI did not stand in the way of the recent rupee appreciation, perhaps to create space for the exchange rate absorb the tariff shock without constraining monetary policy freedom. It may also be politically expedient to not let the FX policy stand out while trade deal negotiations are underway.

The fall in the real effective exchange rate due to lower domestic inflation has also allayed currency competitiveness concerns.

The rupee could still trade with a depreciation bias in 2025. The key risk is from any significant weakness in the Chinese yuan, which the RBI will monitor and match.

The RBI’s durable liquidity injections by increasing domestic assets on its balance sheet also imply a gradually weaker rupee ahead. A soft growth low inflation environment marked by meaningful monetary policy easing and fiscal discipline augurs well for bonds. Bond yields may continue to ease.

Dhiraj Nim is Economist & FX Strategist, ANZ

This is a version of work originally published on ANZ Research on April 9, 2025 (“Reserve Bank of India turns accommodative”) and April 3, 2025 (“Impact of US tariffs on India: first thoughts”). Subscribers can access both pieces of research here.

-

-

-

anzcomau:Bluenotes/global-economy,anzcomau:Bluenotes/asia-pacific-region,anzcomau:Bluenotes/international-economy

India: calls for a stronger policy push amid risks

2025-04-16

/content/dam/anzcom/images/article-hub/articles/institutional/2024-12/dhiraj-nim-thumbnail.jpg

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

EDITOR'S PICKS

-

South Korea’s constitutional court unanimously upheld the impeachment of President Yoon Suk Yeol, triggering a snap election. What now for the economy facing 25 per cent US tariffs?

14 April 2025 -

President Trump’s reciprocal tariffs have been announced. But are they really reciprocal?

9 April 2025